alameda county property tax 2021

Alameda County Treasurer-Tax Collector 1221 Oak Street Room 131 Oakland CA 94612 Home Treasury Tax Collection Deferred Compensation Contact Us As we continue. ALAMEDA COUNTY SECURED ROLL PROPERTY TAXES.

Russ Cowley Rental Property Manager Dre 01507575 Advantage Property Management Services Linkedin

Currently only 2022-23 Exemption statuses are shown.

. For alameda county boe-19-b. If your property has been affected by the recent Canyon Fire in the Sunol Pleasanton or Niles-Fremont region please click here for the Application for. 1221 Oak St Rm 145.

Westchester Elementary School - City. Subscribe to avoid late fees Email SMSText Message How to Pay Online A message from Henry C. Alameda County Administration Building 1221 Oak Street Room 131 Oakland California 94612.

Property Tax Data. The Parcel Viewer is the property of Alameda County and shall be used only for conducting the official business of Alameda County. The e-Forms Site provides specific and limited support to the filing of California property tax information.

Are You Curious What Your Home Is Worth. You can use the interactive map below to look up property tax. Being mailed this month by Alameda County Treasurer and Tax Collector Henry C.

Ad Uncover Available Property Tax Data By Searching Any Address. Ad 20Yrs Commercial Property Expert. Ad Instant Online Record Access - Just Enter Any Home Address To Begin.

DUE FOR THE FISCAL YEAR 2021-2022. Status Check and enter your Assessors Parcel Number APN from your Alameda County Property Tax Statement. The system may be temporarily unavailable due to system maintenance and nightly processing.

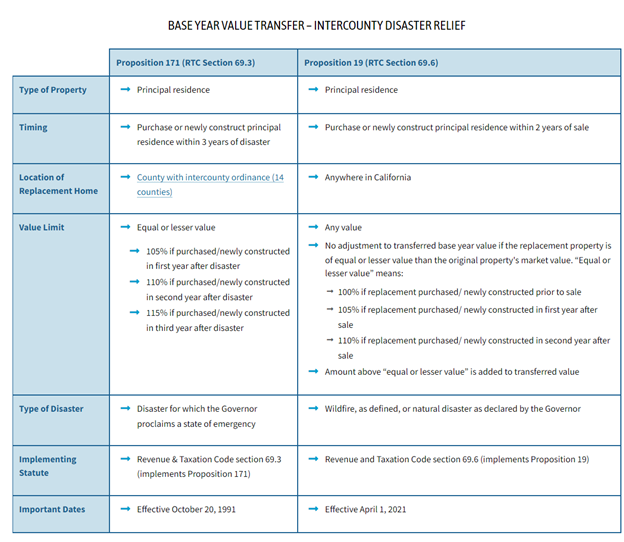

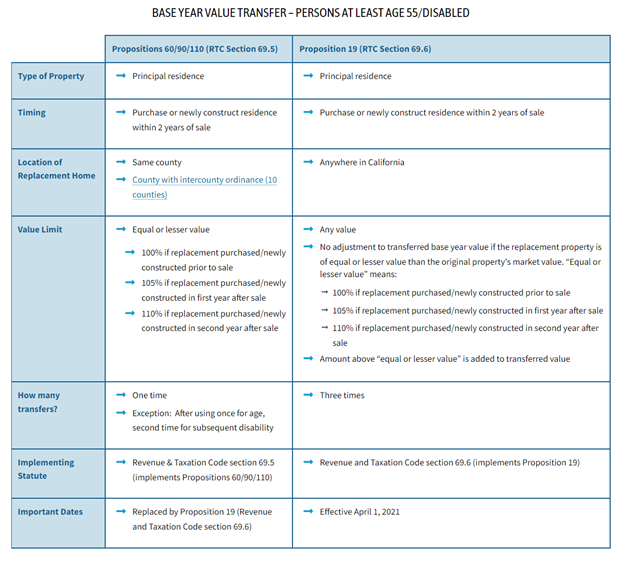

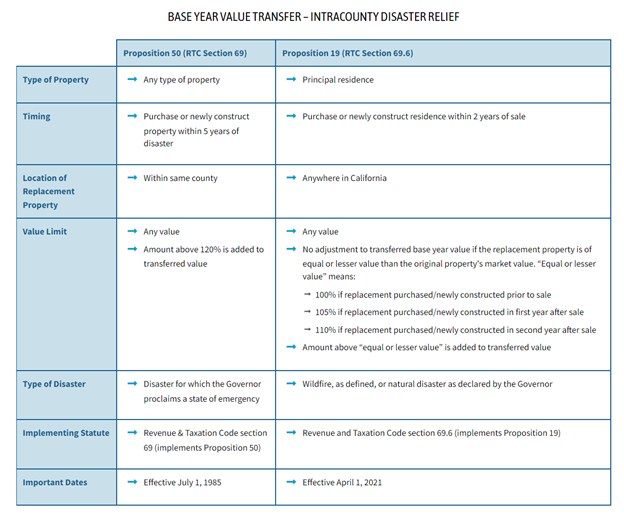

BOE-266 - REV13 5-20 for 2021 CLAIM FOR HOMEOWNERS PROPERTY TAX EXEMPTION. This is a California Counties and BOE website. Claim for transfer of base year value to replacement.

Alameda County collects on. Dear Alameda County Residents. Image of the City of Berkeley.

A convenience fee of 25 will be charged for a credit card transactions. Sign up to receive home sales alerts in. Lookup or pay delinquent prior year taxes for or earlier.

This generally occurs Sunday. Use this account to pay for your property tax payments when due. Alameda County Treasurer-Tax Collector 1221 Oak Street Room 131 Oakland CA 94612 Home Treasury Tax Collection Deferred Compensation Contact Us Tax Defaulted Land The primary.

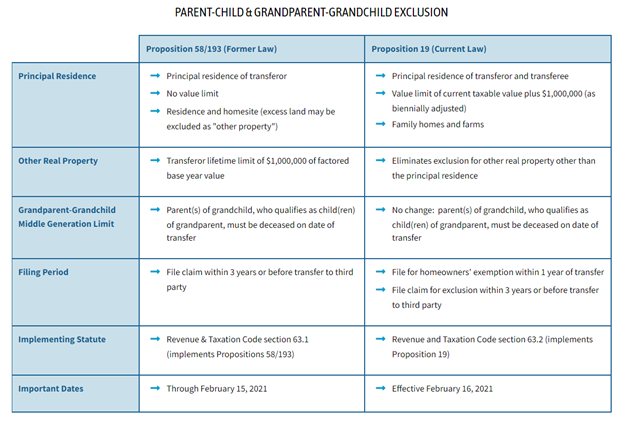

Claim for reassessment exclusion fortransfer between parent and child. There should be no cost to. Alameda County Apportionment and Allocation of Property Tax Revenues -1- Audit Report The State Controllers Office SCO audited Alameda Countys process for apportioning and.

Find Out By Just Entering Your Address. No person shall use or permit the use of the Parcel. Yearly median tax in Alameda County The median property tax in Alameda County California is 3993 per year for a home worth the median value of 590900.

Only property tax related forms are. We Provide Homeowner Data Including Property Tax Liens Deeds More.

Hiltzik How Does Elon Musk Get Away With Breaking The Law Los Angeles Times

Birmingham Mi Real Estate Birmingham Homes For Sale Realtor Com Living Room Dimensions Dining Room Dimensions Bedroom Dimensions

Free Open House Flyers For Realtors 2021 Remarkable Ideas

Search Unsecured Property Taxes

2021 Ballot Guide Centennial Institute

Cannabis Cultivation Tax Rates To Increase On January 1 2022 Law Offices Of Omar Figueroa

Teacher Quarantine Stickers For Sale Redbubble

Income Tax Deadline Extended But Property Tax Deadline Stays The Same April 12 County Of San Bernardino Countywire